Investing Simplified: Choosing Between Stock Trading and Mutual Funds with the Right Help

When it comes to growing your wealth, two powerful options often top the list: equity stock trading and mutual fund investments. Both can be highly rewarding, but they also require knowledge, strategy, and sometimes a helping hand to navigate.

Whether you’re just beginning your investment journey or trying to make smarter money moves, understanding these paths—and the professionals who guide them—can make all the difference.

What Is Equity Stock Trading?

Stock trading is all about buying and selling shares of publicly listed companies. When you buy a stock, you become a partial owner of that company. As the company grows and performs well, the value of your stock can rise—earning you profits. You can also earn through dividends, which are regular payouts made by profitable companies.

There are two main types of equity trading:

- Intraday Trading: Buying and selling stocks on the same day. It’s fast, exciting, and risky.

- Delivery Trading: Buying stocks and holding them for a longer period—days, months, or even years.

Trading platforms and apps like Zerodha, Groww, or Upstox have made it incredibly easy to start, but ease doesn’t replace strategy, timing, and market understanding. If you’re not prepared, you can lose money just as quickly as you earn it.

What is Mutual Funds?

Mutual funds pool money from multiple investors and invest it in stocks, bonds, or other assets. These funds are managed by professional fund managers who aim to generate returns while managing risks.

For beginners or those with limited time, mutual funds offer a great alternative to direct trading. Instead of choosing individual stocks, you invest in a ready-made basket of diversified assets aligned with your goals.

There are different types:

- Equity Mutual Funds: Focus on stocks.

- Debt Mutual Funds: Invest in fixed-income assets.

- Hybrid Funds: Combine both for balanced risk.

But with hundreds of schemes out there, it can get overwhelming. That’s where Mutual Fund Distributors (MFDs) come in.

Who Can Help You Invest Wisely?

💼 The Role of a Stockbroker

If you’re leaning toward stock trading, a registered stockbroker is your go-to partner. They:

- Provide trading platforms to buy/sell shares.

- Help with market research and reports.

- Charge brokerage fees (flat or percentage-based).

- Offer insights—but you’re the one making the trades.

Choosing the right broker depends on your needs—do you prefer a discount broker with low fees or a full-service one with in-depth research and personal advice?

📊 The Role of a Mutual Fund Distributor

On the mutual fund side, MFDs act like personal investment coaches. They:

- Understand your goals (retirement, education, wealth creation).

- Recommend suitable mutual fund schemes.

- Assist with digital onboarding and paperwork.

- Monitor your investments and help with rebalancing.

Unlike financial advisors (who offer holistic planning), MFDs focus on mutual funds alone. They usually earn a commission from fund houses, not from you.

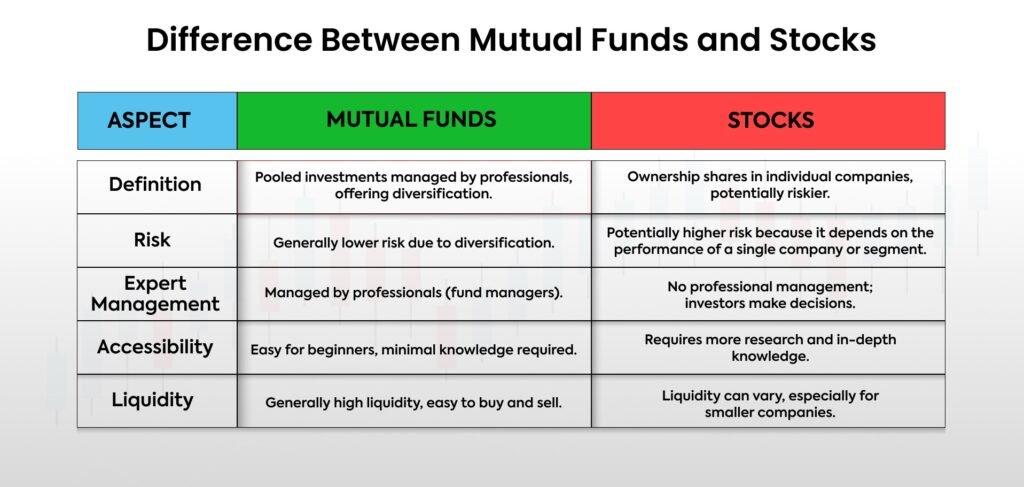

Stock Trading vs Mutual Funds: What’s Right for You?

The decision depends on your personality, risk appetite, financial goals, and time. Some people even do both—trading for fun and funds for future.

How to Get Started the Smart Way

- ✅ New to investing? Start with a mutual fund via a registered MFD to learn the ropes.

- 🧪 Love market trends? Explore equity trading but begin with small amounts.

- 💡 Need help? Look for AMFI-registered mutual fund distributors or SEBI-registered brokers.

- 📱 Prefer convenience? Many platforms now offer app-based support, dashboards, and even human advisors via chat or call.

Final Thoughts: The Human Side of Investing

Investing isn’t just about money—it’s about building security, dreams, and a better future. Whether you choose to ride the waves of the stock market or opt for the steady pace of mutual funds, what matters is that you make informed, confident choices.

And you don’t have to do it alone.

There are professionals ready to walk with you—be it a stockbroker explaining market signals or a mutual fund distributor aligning your funds with your goals.

Start small. Stay consistent. And always, invest with purpose.

No responses yet