Mastering Derivatives Trading: A Beginner’s Roadmap to Smarter, Safer Financial Moves

In today’s fast-paced financial world, making smart money moves goes beyond just buying and holding stocks. A powerful strategy that more investors are turning to is derivatives trading—a method that, when used wisely, can manage risk, multiply profits, and open up opportunities that traditional investing can’t match.

But let’s be honest—“derivatives” sounds technical and maybe even a little intimidating. The good news? You don’t need to be a financial expert to get started. With the right understanding and tools, even beginners can step into this space confidently.

This guide is designed to help you understand derivatives in simple terms, know why they matter, and show you how to get started using a trading platform that works for you.

What are Derivatives?

The financial agreement known as a derivative contract obtains its value from a base asset.

That asset could be anything:

👉 Stocks (like TCS, Reliance)

👉 Market indexes (like Nifty or Sensex)

👉 Commodities (like gold or crude oil)

👉 Currencies (like USD/INR)

You’re not buying the asset itself—you’re buying a contract that tracks how that asset will behave in the future.

Think of it this way:

Imagine you believe gold prices will rise in the next 30 days. Instead of buying physical gold, you enter into a futures contract to buy gold at today’s price. If the price goes up, you profit from the difference—without ever touching the gold itself.

Why Do People Trade Derivatives?

Now you might wonder, why not just trade regular stocks or commodities? What’s the big deal about derivatives?

Here’s the answer—flexibility and control.

1. Hedging Risk

Derivatives are widely used to protect your investments. For example, if you own a stock but fear it might fall, you can use an option or future to reduce potential losses.

2. Speculation

Traders also use derivatives to make short-term bets on price movements—without owning the asset. This can mean quick profits, but also higher risk.

3. Amplified Profits

Because derivatives allow you to trade with leverage (a small investment for a larger position), you can earn big from small market moves. However, keep in mind that more profit also entails greater risk.

4. Advanced Strategies

Derivatives offer opportunities to earn even in falling markets, lock in future prices, or balance your entire portfolio using smart, professional-style strategies.

Types of Derivatives Explained

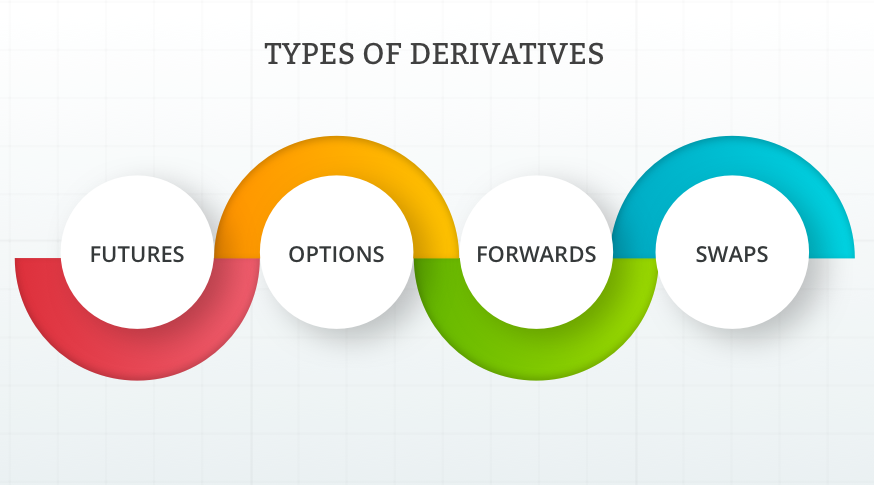

Let’s decode the four major types:

📘 Futures

An agreement to buy or sell an asset at a fixed price on a future date.

Example: Buy Nifty Futures at 22,000 for delivery in August.

📘 Options

A flexible contract that gives you the right but not the obligation to buy/sell.

Example: You can choose whether or not to buy a stock at ₹100 before the expiry date.

📘 Forwards

Like futures, but more customizable and traded privately (not on exchange).

🔹 Used mostly by big firms and institutions.

📘 Swaps

Contracts where two parties exchange payment types—such as switching from a fixed interest rate to a floating one.

🔹 Mostly used in international finance and corporate hedging.

Futures and Options (F&O) are the most accessible and popular option for the majority of Indian retail traders.

How Derivatives Trading Works (Step-by-Step)

Starting with derivatives is not as hard as it sounds. Here’s what you need to do:

- Open a Trading Account

Sign up with a broker that supports F&O (like Zerodha, Upstox, Angel One, etc.). - Fund Your Account

Add money to meet the margin requirement. - Choose Your Contract

Select from stock futures, index options, commodity futures, etc. - Do Your Analysis

Use charts, news, and technical indicators to make your decision. - Place Your Order

Buy or sell the contract based on your strategy. - Monitor and Exit

Keep an eye on price movement, and close your position before expiry or at your target.

The Risk Side: What You Need to Watch Out For

Trading derivatives is exciting, but it comes with real risks. You must respect them:

· Leverage Risk: A small move in price can lead to big gains—or big losses.

· Complexity: You’ll deal with expiry dates, strike prices, and margin calls.

· Emotional Decisions: High volatility can make people panic—be disciplined.

· Overtrading: More tools = more temptation to trade without a plan. Avoid it.

Solution? Start small. Use demo accounts. Learn consistently. Stick to strategies

What Is a Derivatives Trading Platform?

A derivatives trading platform is your digital dashboard—an app or software that lets you buy, sell, and monitor futures and options contracts.

It’s not just a place to place trades. It’s your command center.

A good platform provides:

- 📊 Live market data & advanced charts

- 📈 Option chain analysis

- ⚙️ Margin calculator & risk management tools

- 🔔 Custom alerts & notifications

- 🎓 Learning content for traders of all levels

Best Derivatives Trading Platforms in India

Here’s a quick overview of some trusted platforms:

Platform | Why Traders Like It |

Zerodha Kite | Smooth design, fast charts, good for beginners & pros |

Upstox Pro | Great speed, advanced charting, low-cost trades |

Angel One | Algo trading + SmartAPI integration |

ICICI Direct | Strong for those who also use ICICI banking |

Groww & Paytm Money | Easy-to-use, entering F&O trading scene |

And for international traders, platforms like Thinkorswim, Interactive Brokers, and MetaTrader offer global access with powerful tools.

Final Word: The Smart Path to Derivatives Success

Derivatives trading isn’t just for finance geeks or big investors.

With the right mindset, tools, and education, anyone can learn it—and even master it.

✅ Start by understanding the basics

✅ Choose the right platform

✅ Use demo accounts to practice

✅ Learn new things all the time through blogs, live marketplaces, and classes.

✅ Never risk more than you can afford to lose

Remember: In trading, discipline matters more than luck.

So if you’re serious about growing your wealth through smart, strategic steps—derivatives trading might just be your next big move.

No responses yet